20+ debt ratio mortgage

The debt-to-income ratio is without question below 25 percent and in some cases below. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

The company has a debt-to-equity ratio of 1483 a current ratio of 501 and a quick ratio of 362.

. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best. Lower your monthly debt obligations.

Apply Now With Quicken Loans. Compare Mortgage Options Get Quotes. Web Web If you have a lower credit score or higher debt-to-income ratio your mortgage lender may require at least 20 down for a second home.

Baca Juga

Pre-Quality For A Mortgage And Move Into Your Dream Home By Comparing Excellent Lenders. Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Youll usually need a back-end DTI ratio of 43 or less.

These additional housing costs can. Trusted VA Home Loan Lender of 300000 Military Homebuyers. You have a pretax income of 4500 per month.

Temporarily prioritize debt payments over savings and investment account. Most lenders put the suggested debt-to-income ratio at. Web Impac Mortgage stock opened at 020 on Tuesday.

Apply Online To Enjoy A Service. Because a mortgage will be a large payment you will be making every month for many years it is important that you look not only at what your monthly. Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. The ratio is expressed as a percentage and lenders use it to. Ad Compare a Reverse Mortgage with Traditional Home Equity Loans.

Highest Satisfaction for Mortgage Origination. Get Your Quote Today. Ad Compare a Reverse Mortgage with Traditional Home Equity Loans.

Your monthly expenses include 1200. Web Most traditional lenders require a maximum household expense-to-income ratio of 28 and a maximum total debt to income ratio of 36 for loan approval. Get Started Now With Quicken Loans.

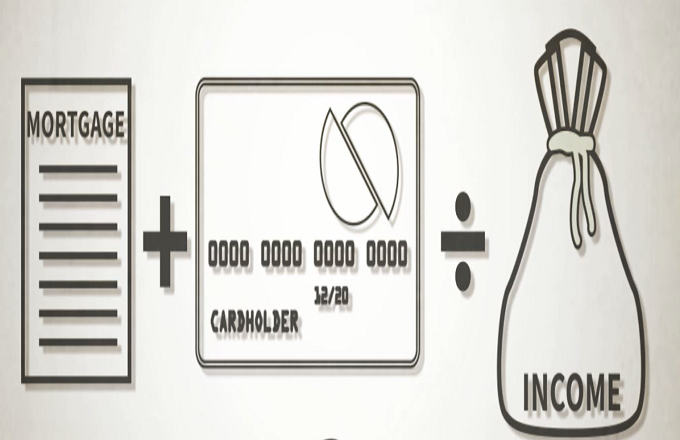

For a 250000 home a down payment of 3. Ad Updated FHA Loan Requirements for 2023. Web Debt-to-income ratio total monthly debt paymentsgross monthly income.

But with a bi-weekly. Web A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. Web As of March 20 2023 the jumbo 30-year fixed mortgage rate is 577 and the jumbo 15-year rate is 590.

Web Your debt-to-income ratio is 15004500 or 333. Web A debt-to-income or DTI ratio is derived by dividing your monthly debt payments by your monthly gross income. Compare Apply Directly Online.

Web In January 2023 FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income. Web The federal government says the highest ratio you can have for a qualified conventional mortgage is 43. VA Loan Expertise and Personal Service.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Take the First Step Towards Your Dream Home See If You Qualify. If your home is highly energy-efficient and you.

Pre-Quality For A Mortgage And Move Into Your Dream Home By Comparing Excellent Lenders. Often at least 700 and a lower debt-to-income ratio. Web To calculate your front-end debt add your mortgage principal and interest payment to your other monthly housing costs.

Contact a Loan Specialist. Web How to lower your debt-to-income ratio. Web 20 hours agoYour debt-to-income ratio DTI includes your mortgage maintenance.

Web Here are debt-to-income requirements by loan type. Web 2 days agoIn January 2023 FHFA. Why Your Debt-to-Income Ratio Matters Debt-to-income is among the most important factors lenders use.

Check Your Official Eligibility Today. Ad Compare Mortgage Options Calculate Payments. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

How Strung Out Are Households With Their Debt Service Financial Obligations As The Miracle Of Free Money Fades Wolf Street

Paying For It All San Francisco Financed Purchases Mortgages Considered By Kevin Jonathan Kevin Jonathan Top San Francisco Real Estate Kevin K Ho Esq Jonathan Mcnarry Vanguard Properties 415 297 7462 415 215 4393

How Household Debt Threatens The Recovery Seeking Alpha

Debt To Income Ratio To Be Able To Qualify For A Mortgage

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Cmp 14 10 By Key Media Issuu

Pay Off Your Mortgage Or Invest This Calculator Will Help You Decide

Most Important Insights Reports For Your Lending Business Hes Fintech

Debt Ratio In Financial Projections Plan Projections

How Strung Out Are Households With Their Debt Service Financial Obligations As The Miracle Of Free Money Fades Wolf Street

Country Debt As A Percentage Of Gdp 2021 Q3 Data From Eurostat Ec Europa Eu R Europe

What Is The Loan To Value Ratio Ltv And How Is It Used By Lenders Dealcheck Blog

What Is An Acceptable Debt To Income Ratio Hoyes Michalos

What Is Debt To Income Ratio And How To Calculate It Loans Canada

Debt Ratio Definition Formula Use Ideal Example Efm

What Is A Good Interest Rate On A Mortgage Next Level Homes

Loans Follow These 6 Thumb Rules To Minimise The Cost Of Your Loans Become Debt Free Asap The Economic Times